Manage Tax and VAT settings for your event

Starting from our Light package, idloom-events’ customers have the possibility to organise paid events, and to have guests pay either directly on the platform or via bank transfer. But who says flow of money, says taxes.

This is why we have developed a custom VAT module, allowing you to set up your event in compliance with the most complex tax legislations.

Setting up tax/VAT

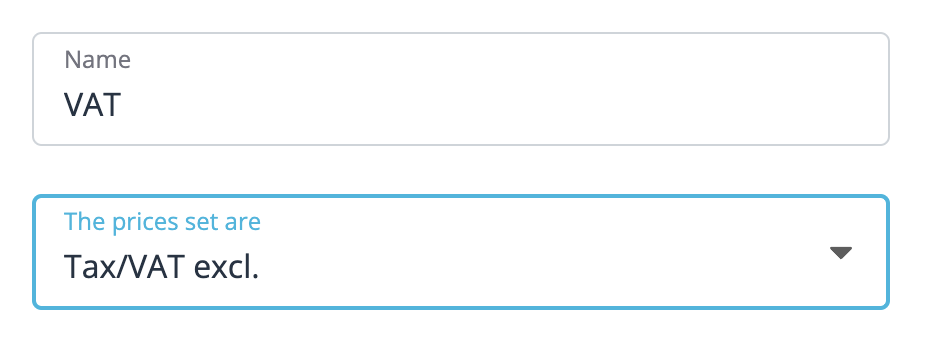

From your event’s editing page, in the section “Money” select “Tax/VAT”.

|

|

- No tax/VAT: registrants will pay the exact amount that you’ll set up and no tax/VAT will be added at the checkout.

- VAT incl.: registrants will pay the exact amount that you’ll set up. Upon checkout, the system will calculate the percentage of the set price that is Tax/VAT.

- VAT excl.: the system will automatically add the percentage of Tax/VAT you’ll have set to the list price you’ve entered (ex: 100€ list price + 21% VAT means that the registrant will be asked upon checkout to pay 121€, even though you have listed a 100€ price tag).

Tax rates and application rules

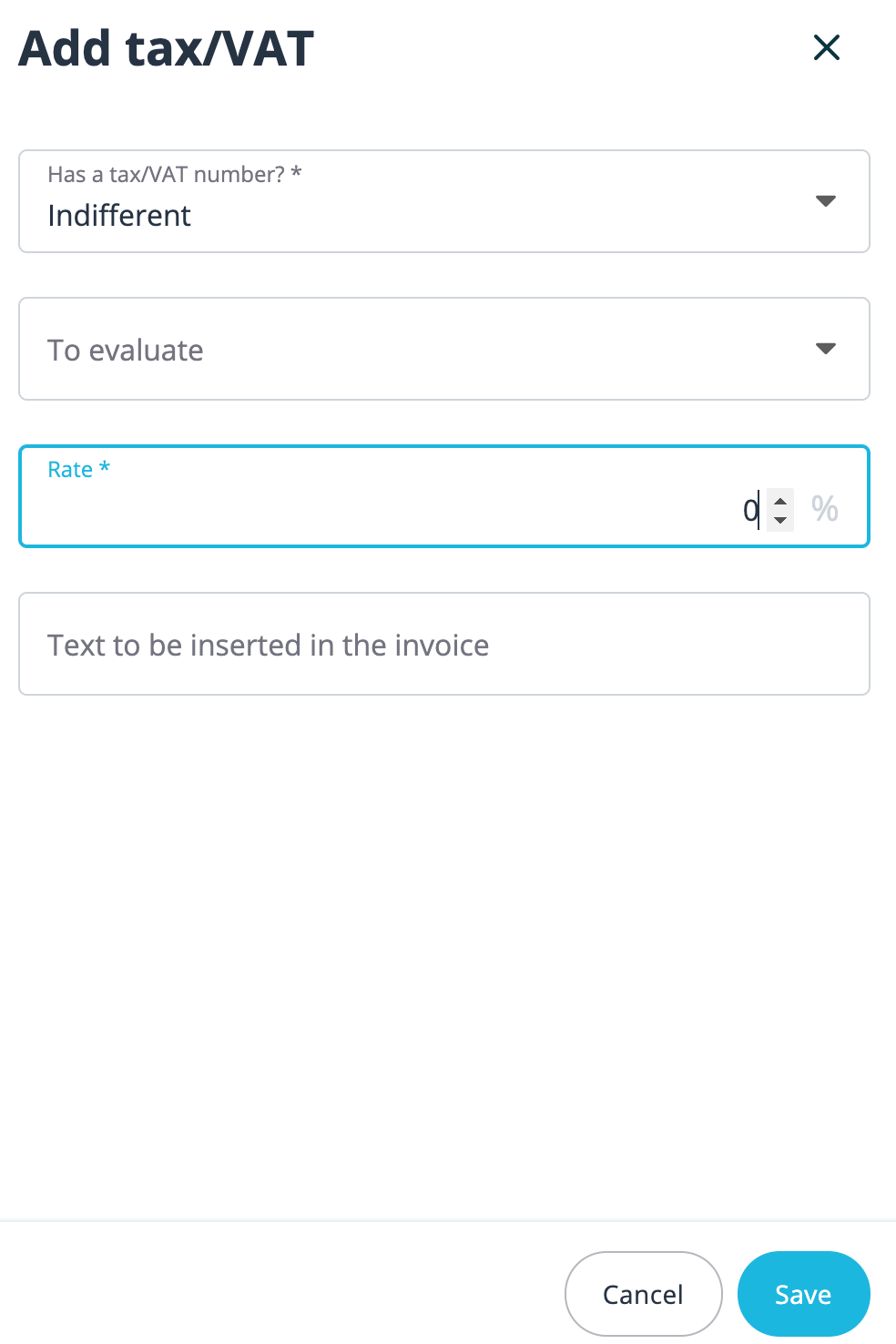

You can build the list of conditions and applicable tax rate to apply to your registrations. The conditions are evaluated in their list order. If the condition is met, the tax rate is applied, if not the next one is evaluated. If no condition is met, no tax will be applied. You can drag and drop the conditions to change their order based on your requirements.

Click on the green “+ Add tax/VAT” and define your first rule.

|

|

Please note that several conditions might be true for one single registration. In that case, only the first condition met will be applied. You can drag and drop the conditions to change the order based on your requirements.

Examples

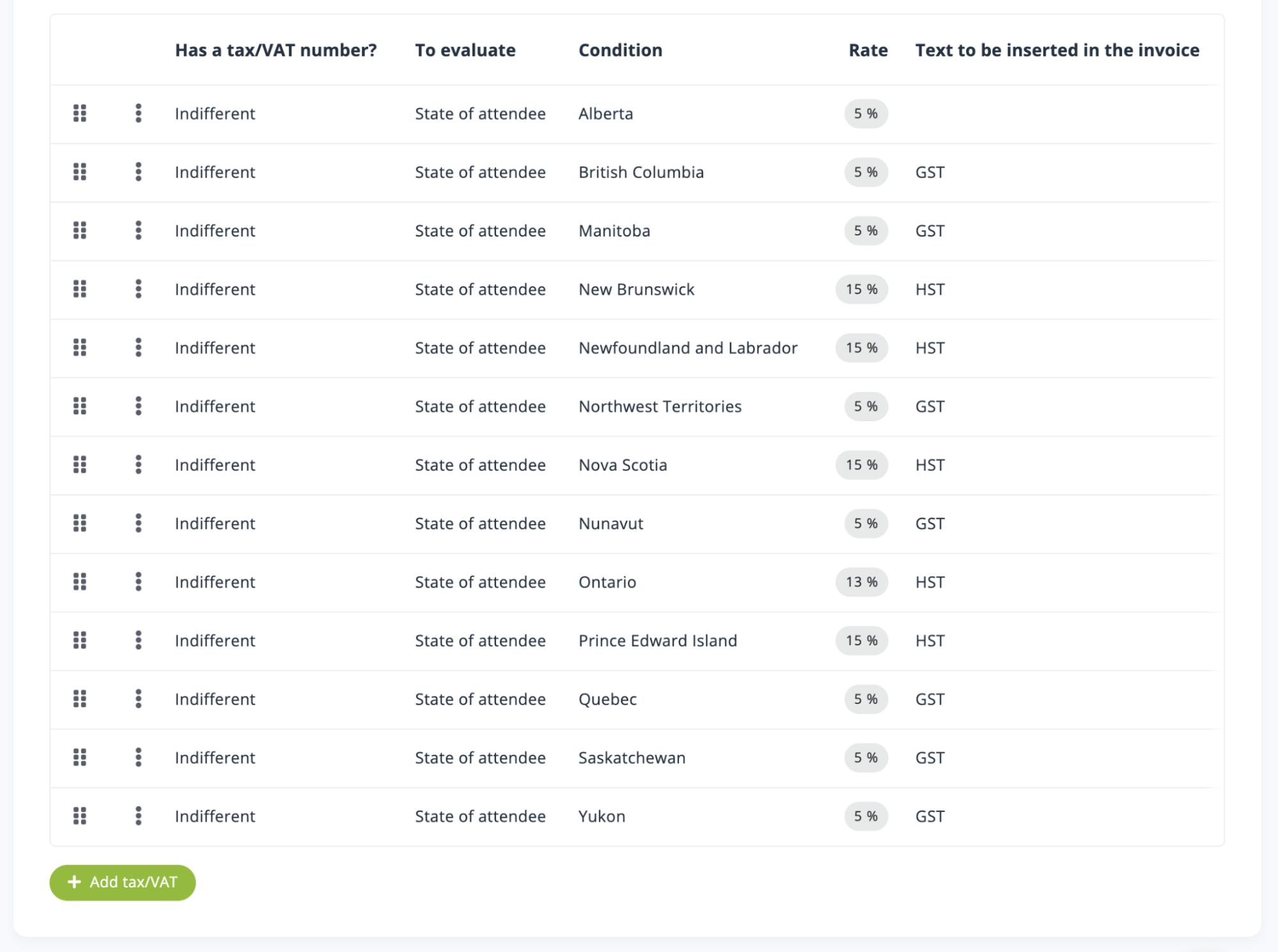

GST/HST application for Canada

In this example, the application tests the registrant province to set the appropriate tax type and rate. The state field is mandatory and the state list is predefined to make sure at least one condition is met.

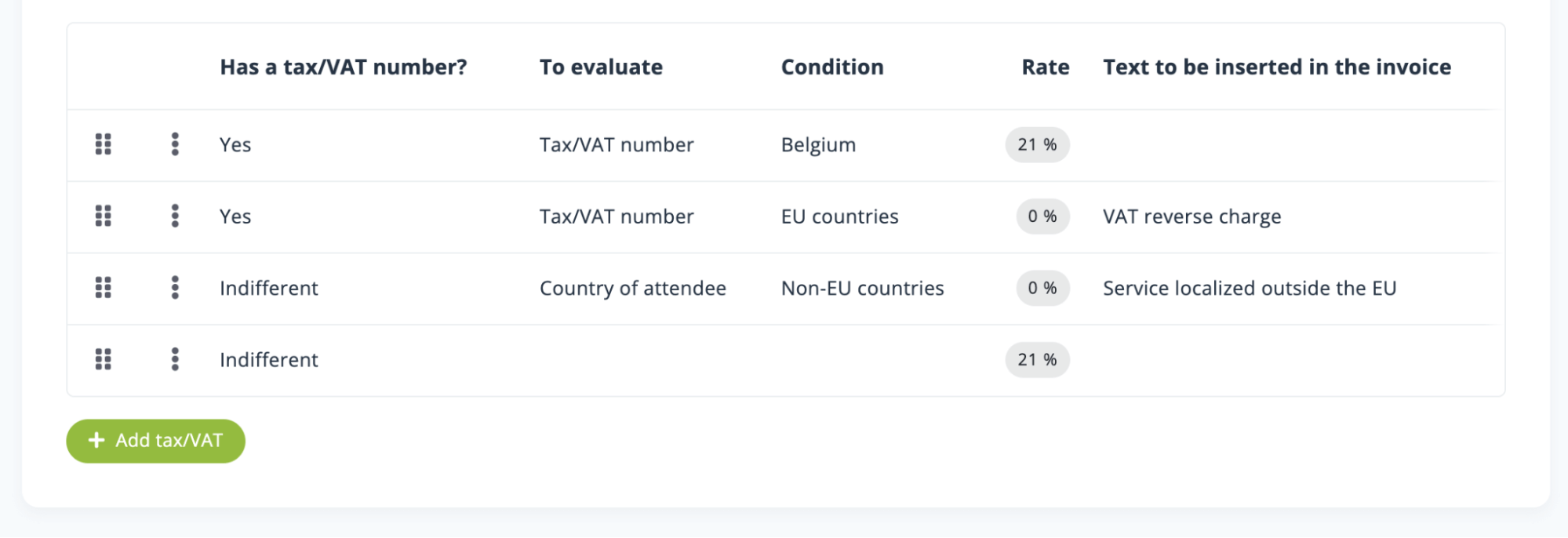

VAT application for an online conference (VOD like) in Europe

In this example, the organiser is localised in Belgium.

- The application first tests the registrant VAT number to check if it is prefixed with “BE”, and if the condition is met, set the VAT rate to 21% (VAT rate applicable for such services in Belgium).

- If the previous condition is not met, it then tests if the VAT number prefix is one of another EU member country, and if so, applies a 0% VAT rate and mentions “VAT reverse charge” on the invoice or receipt.

- If the previous condition is not met, it then tests if the country of the registrant is outside the EU, and, if the condition is met, sets the VAT rate to 0% and mentions “Service localized outside the EU” on the invoice or receipt

- If none of the conditions were met, it then sets the VAT rate to 21%, which is the default Belgian VAT rate applicable for all EU citizens or organisations without VAT number.

Note that if you don’t set the first condition, the application would set the VAT rate to 0% to all organisations with a VAT number prefixed with “BE”, as Belgium is an EU country.

Thanks to this useful feature, your invoices and accounting documents generated by idloom-events will display the correct tax rate, every time.