Warning: This information has been collected from a specialized consulting firm and transcribed by us. This information may change over time and does not exempt you from taking advice from your accounting firm. idloom can in no way be held responsible for the inaccuracy or misapplication of the information below.

The first criterion to consider is whether your training/conference is live or recorded (pre-recorded video without live interaction).

Interactive or not?

Active participation? If it is a live, interactive session, during which participants can ask questions and make comments, then this type of service qualifies as an educational activity.

No active participation? If it is a pre-recorded video that participants can watch on demand, then it is considered as a service provided by electronic means.

What VAT to apply in the case of an educational activity (active participation)?

The service is located in the country where the organizer is established. In this case, local VAT is to be applied in all cases, whether the participant is established in the country of the organizer or not, and whether he is subject to VAT or not.

For example, if the commercial organizer is established in Belgium, the service is always located in Belgium. It does not matter whether the participant is a private individual or a company, or whether he is established in Belgium or elsewhere. The place of the service is indeed Belgium, and the Belgian VAT of 21% is therefore due.

Which VAT is applicable in the case of an electronic service (video on demand)?

Generally speaking, in the case of an electronic service, the service is located in the country where the participant is established, which leads to specific applications depending on the type of participant.

VAT in a B2B relationship

In this case, the following rules apply:

- If the participant is established in the same member state, local VAT applies.

- If the participant is established in another Member State, the organizer invoices with reverse charge.

- If the participant is established in a third country, the organizer does not charge VAT, but indicates on his invoice "service located outside the EU".

VAT in a B2C relationship

In this case, the following rules apply:

- If the participant is established in the same Member State, local VAT applies.

- If the participant is established in another Member State, the organizer charges the VAT of the participant's Member State. The organizer must therefore charge foreign VAT at the applicable VAT rate of the Member State concerned for the services provided electronically. Registration and declarations can be made via the OSS (One Stop Shop) service.

Pro tip: As long as the turnover threshold of €10,000 excl. VAT for such services to private persons from other Member States is not reached during the calendar year, the organizer can opt to still charge 21% Belgian VAT instead of foreign VAT. - If the participant is established in a third country, the organizer does not charge VAT, but indicates on his invoice "service located outside the EU".

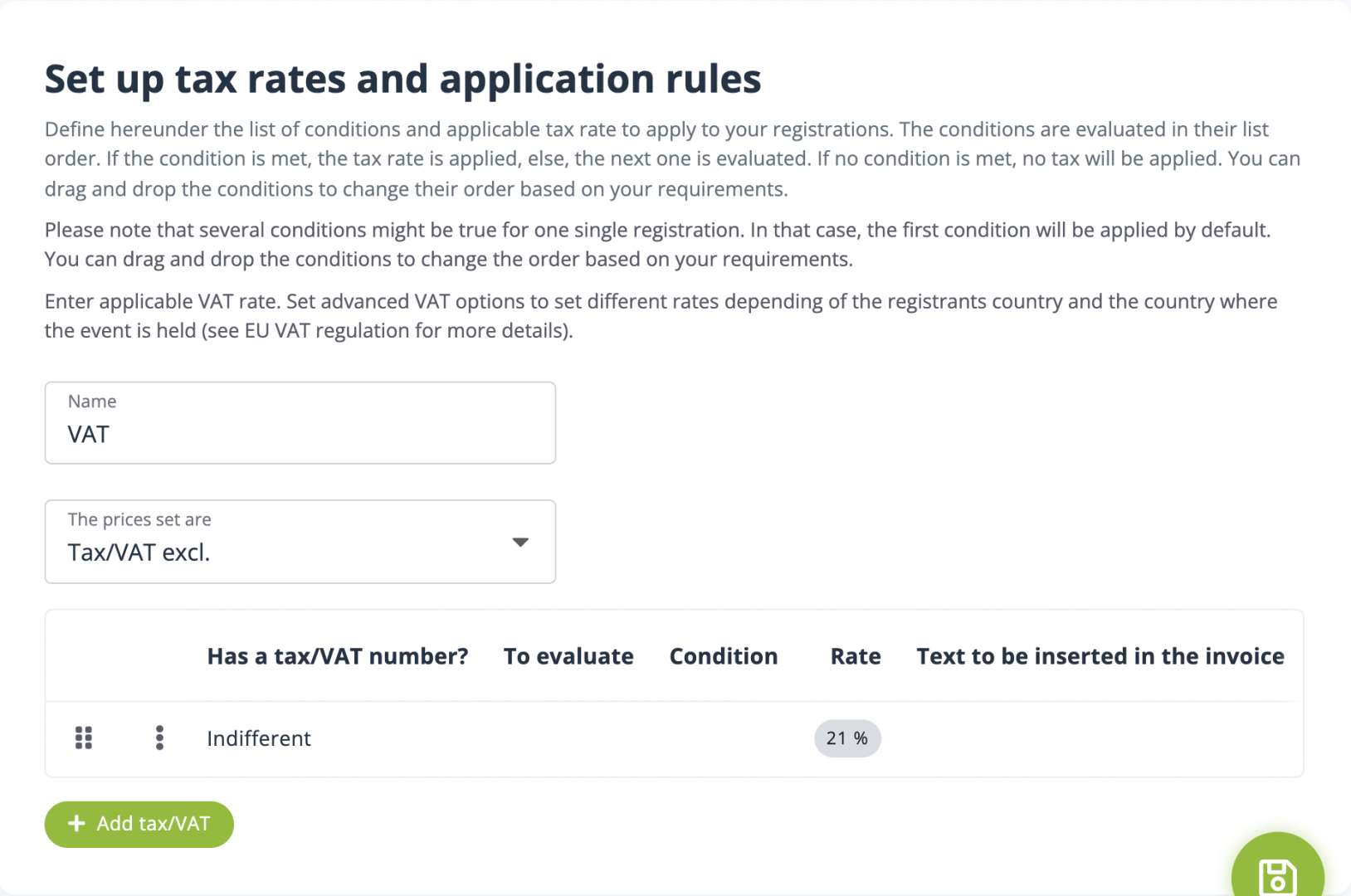

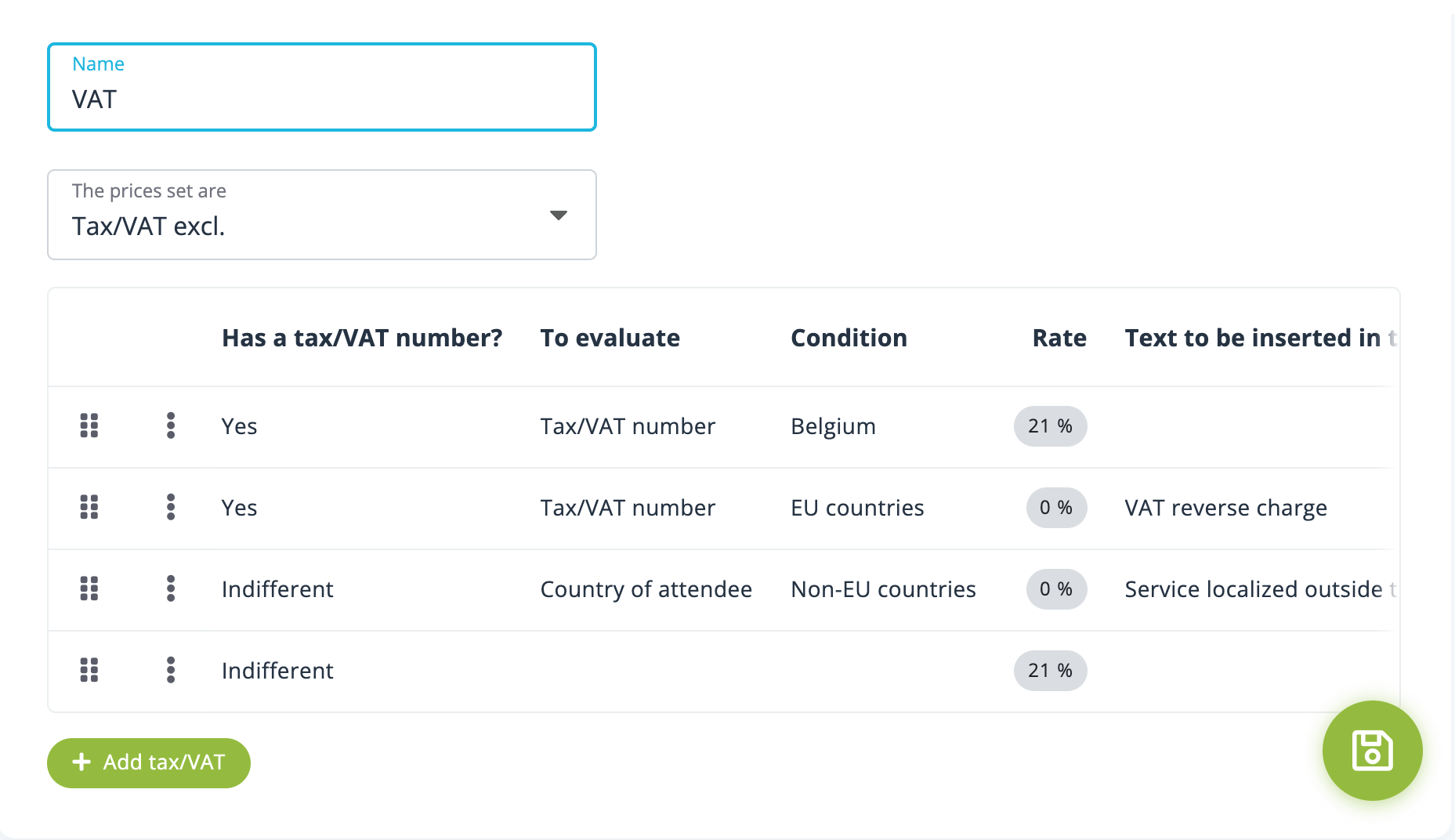

Example of the VAT rule for an electronic service whose organizer is established in Belgium and whose turnover in other member states does not exceed €10,000 excluding VAT:

The conditions are evaluated in the order you determine. As soon as one of them is met, it is applied and the following ones are ignored. It is therefore recommended to process the special cases first and always end with the default condition that applies to all other cases.

In this example, we first process the B2B cases and first the special case of B2B participants in the organizer's country. Next, the B2B participants in the rest of the member states, then all other participants outside the EU and finally the default VAT of 21%, in theory only applicable for all B2C (or non VAT) participants throughout Europe.

Physical events

In the case of a physical event, the VAT to be applied is that of the Member State where the event takes place for this kind of services. If the event is held outside the EU, the service is not subject to EU VAT, even if the organizer is a taxable person in one of the Member States.

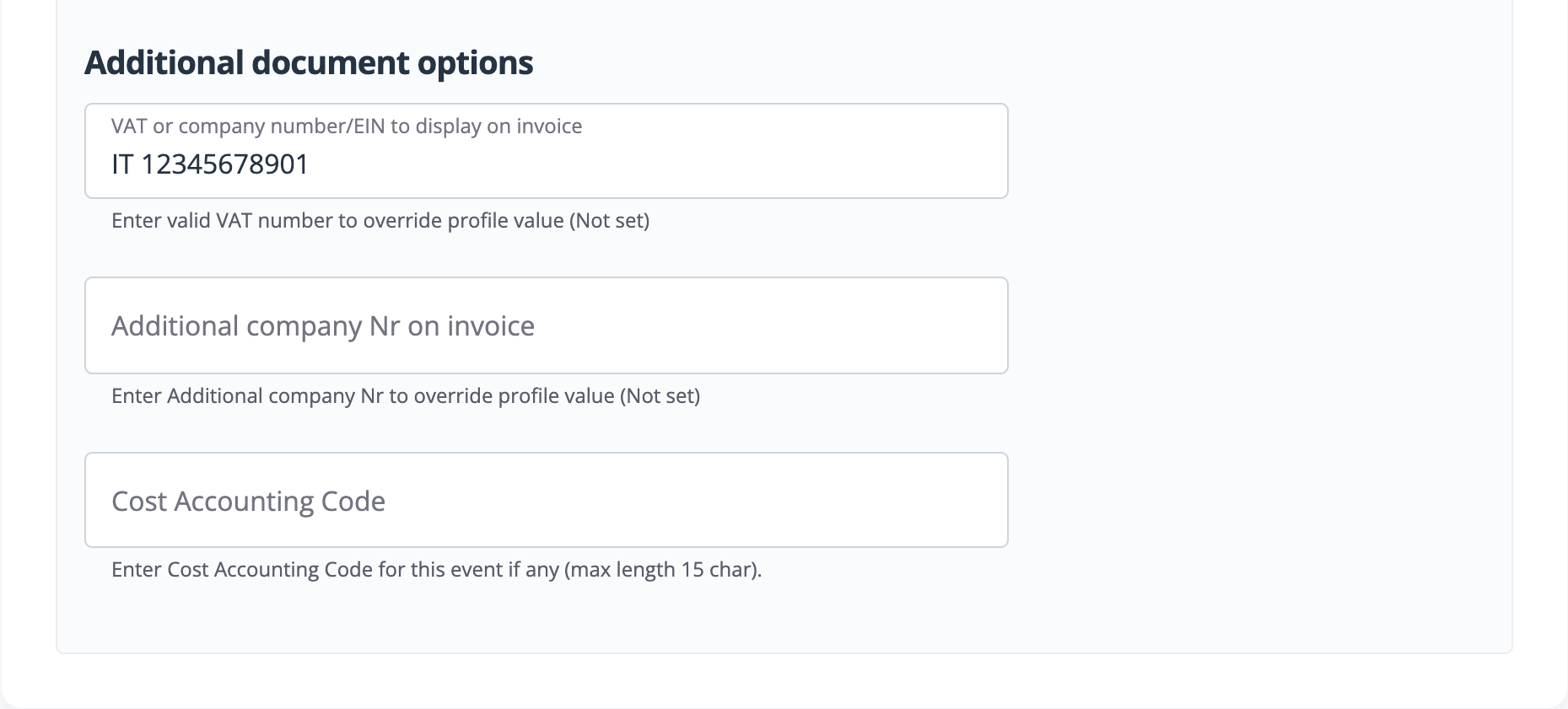

To setup a specific VAT number for an event in idloom.events, go to your event > Receipts and Invoices, and set the following:

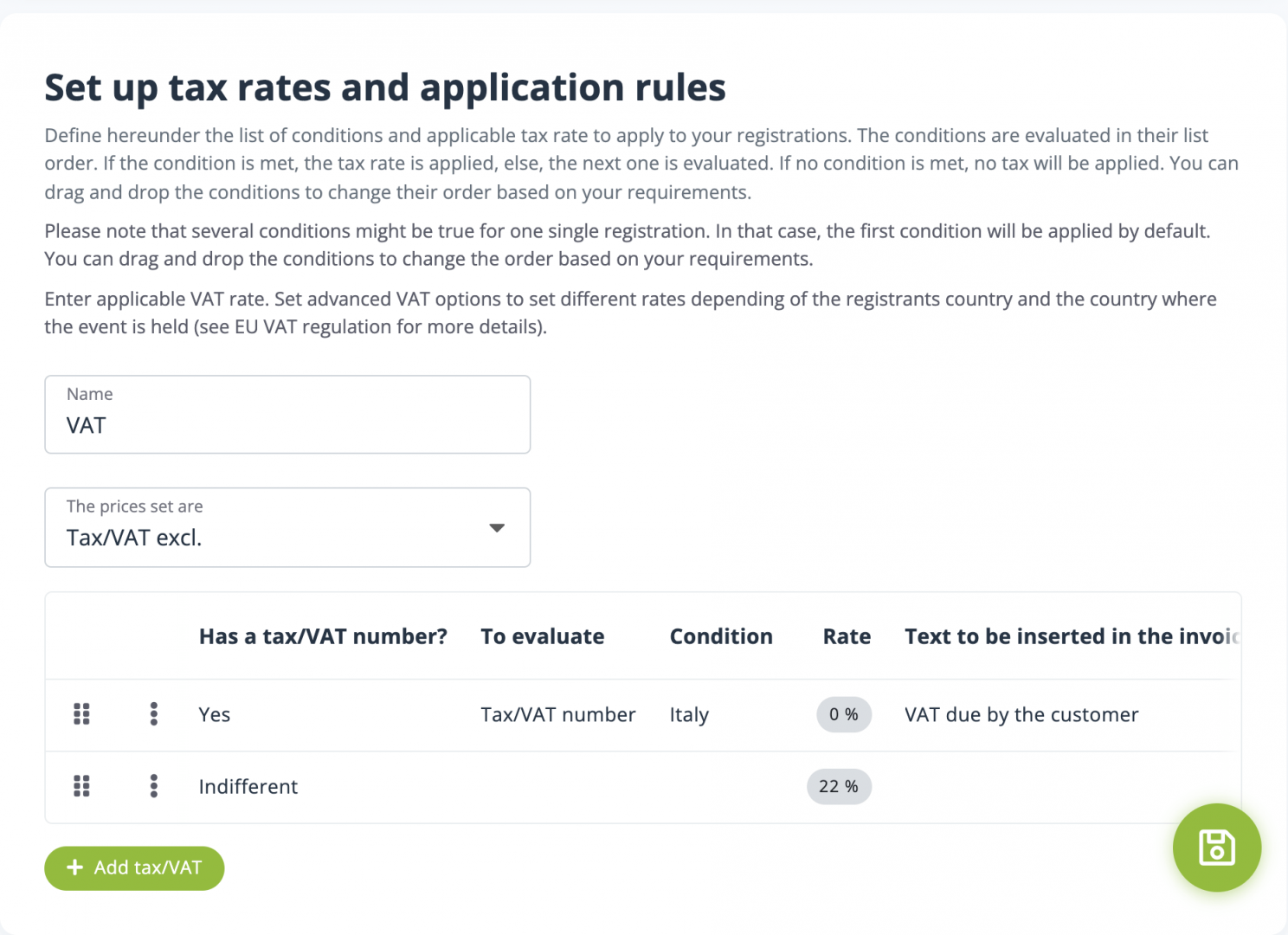

Let's take the example of a French company that organizes an event in Italy. It must register for VAT in Italy and charge the VAT rate for this type of service, i.e. 22%, in all cases.

It should be noted that some Member States allow the deferral of collection (VAT due by the customer) if the taxable person is established in the Member State where the event takes place.

To setup such a behavior in idloom.events, go to your event > Money > Tax/VAT, and set the following: